PDF to Quicken® Tutorial

Often times, bank statements are issued electronically in the PDF format, as statements available to download from the bank’s website. Alternatively paper statements may be scanned and be saved in PDF format. Manually entering transactions from a statement into Quicken® can be extremely time-consuming, especially with business accounts that handle a large volume of transactions, incoming and outgoing.

pdf2qfx Convert allows you to take a PDF bank statement and import the transactions automatically into a Quicken®-ready QFX file. Not only can this save many hours of drudgery, but also reduce the chance of error associated with manual entry.

Getting Started

MoneyThumb converters work with both scanned and downloaded statements. pdf2qfx Convert will convert most downloaded statements, as downloaded statements are generally text-based PDF. For scanned, image-based, or encrypted documents, you will need PDF+, which comes bundled with pdf2qfx Convert+. If you’re not sure which type of PDF you need to convert, see https://www.moneythumb.com/pdf-types/.

This tutorial is based on a short bank statement containing 1 check, 4 withdrawals, and 2 deposits. The converter will work equally well on statements with hundreds of transactions.

Step I - PDF Converter Setup

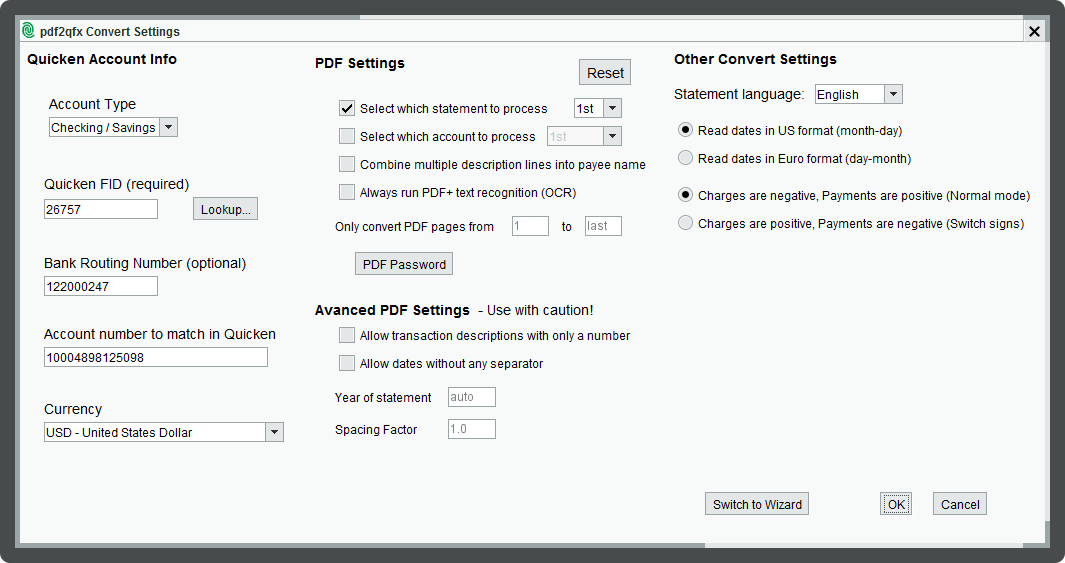

Run either pdf2qfx Convert or pdf2qfx Convert+

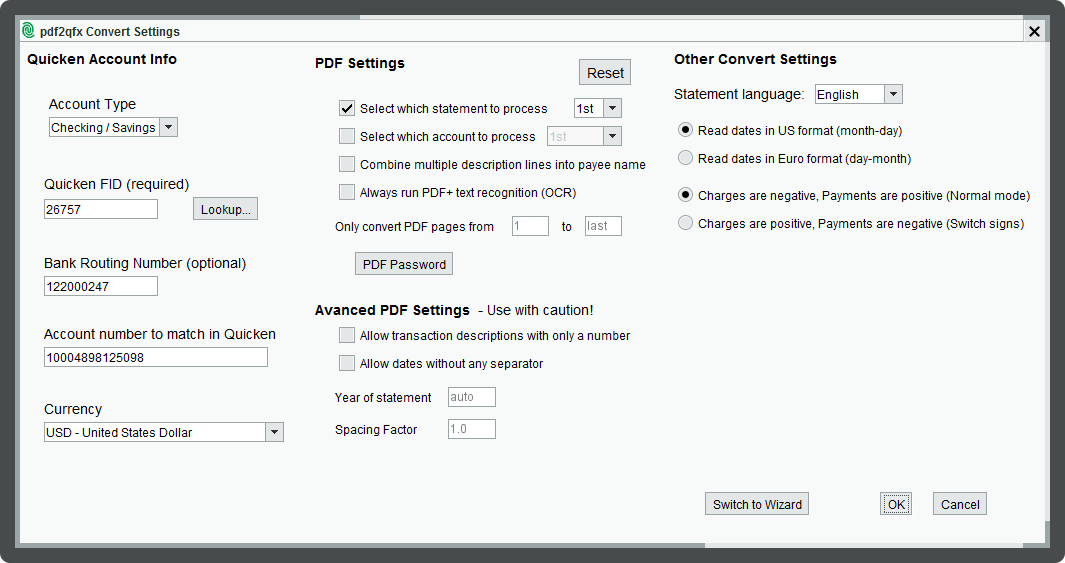

- Select the Settings button to bring up the Settings dialog

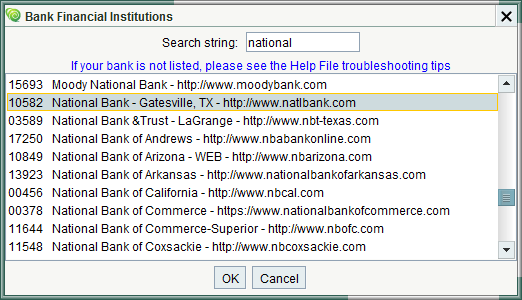

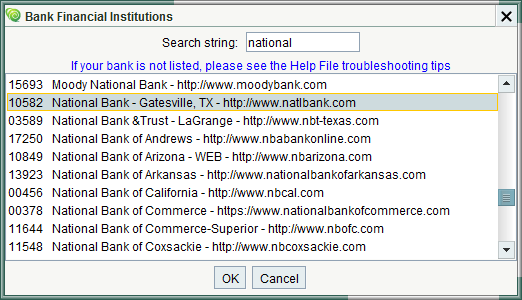

- The Settings menu is divided into three columns. In the left column you should specify the Quicken account type, lookup the FID of the bank to import into, and specify the account number. If your bank is not listed, then Quicken will not import transactions using that bank name, and you have to select a different bank. But you can still name the account anything you want. For our example we will just use the name 'National Bank' which is the name of a bank in Texas.

- In the middle column, if you have a scanned image, it is good idea to select the option for Always run PDF+ text recognition (OCR). The converter will automatically run PDF+ when the file only has scanned images, but some scanners will automatically run a built-in OCR, and the scanned file will then have both text and images (a searchable PDF). In that case you need to specify that PDF+ should run regardless of whether there is text in the PDF. The other options can generally be left as defaults.

- On the right column you should select the correct date type (month-day vs. day-month). The option to switch signs is generally set correctly based on your account type (bank vs credit card), you can also review that later. The checkbox to Use column names should be unchecked the first time you run a conversion with a new bank, and then will automatically be checked on subsequent conversions.

Step II - Extract Transactions and Create the QFX file

- Run the conversion by selecting the big Convert button, which will bring a file chooser. Select the PDF statement to be converted. The first time you run the converter you should select the Preview button in the file chooser to make sure the data is correctly identified. Subsequent conversions with statements from the same bank can be converted in a single step by selecting the Convert to qfx button.

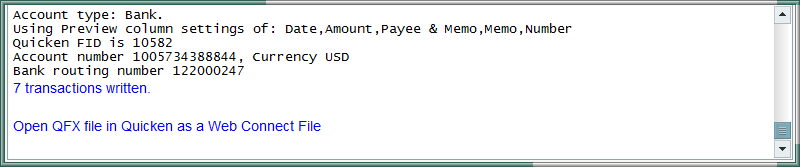

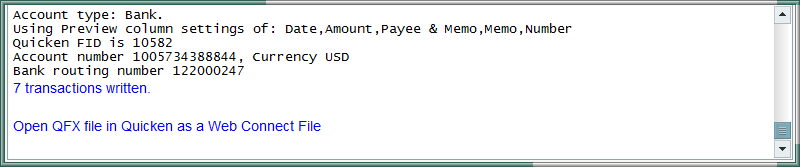

The converter will extract financial transactions from the statement, automatically discarding extra headers, footers, summaries, ads, and other extraneous information in the statement. The converter will display a log with setting information, a summary of each transaction that was extracted, and a reconciliation report.

The converter will extract financial transactions from the statement, automatically discarding extra headers, footers, summaries, ads, and other extraneous information in the statement. The converter will display a log with setting information, a summary of each transaction that was extracted, and a reconciliation report.

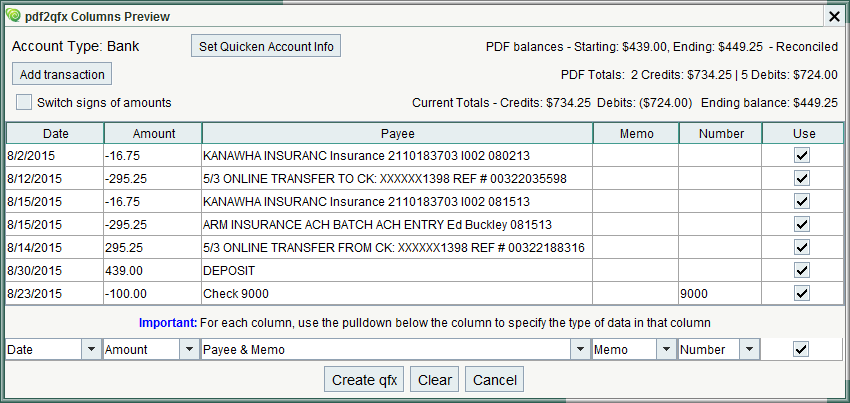

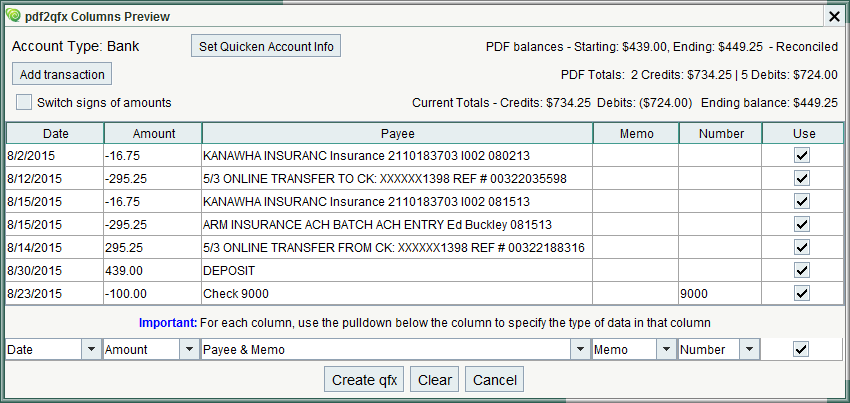

- Preview mode will bring up a spreadsheet-like dialog for confirming the transaction information extracted from the PDF Statement. At the top right is a summary of the information found in the statement; this is automatically updated as you make changes.

- Verify the account type as a bank or credit card. You can also change the Quicken account information from this screen.

- Verify the names of each column, using the pull down menus at the bottom of each column to specify the type of data in that column. This is the most important aspect of preview mode. Most of the columns will automatically be correctly identified, but sometimes the names need to be modified.

- There should be one Date column

- Amounts can either be in one column, or two columns with one for Credits and one for Debits. If there is one column with both credits and debits and all the amounts are positive then there should be another column that contains the transaction Type i.e. credit/debit or cr/db.

- The Payee name is taken from the left most description column and/or the first line of each transaction. Some banks have very long payee names, prefaced by things such as “Check card payment on …” Because QFX format limits the payee to 32 characters, useful information can be lost. One solution for that is to put the payee in both the payee field and the start of the memo field. We will use the Payee & Memo column name to put information in both fields – the Quicken Payee will have the first 32 characters and the Quicken Memo will have the entire string. Other banks use that first column more like a transaction type (Deposit, Credit etc.) and you will need to select a different column as the Payee name.

- The Memo field contains text from additional lines in the transaction, or additional description columns. Sometimes there are two such columns and you can use Memo Add-on to specify that a second field be concatenated to the Memo field. You can combine Payee & Memo, Memo, and Memo Add-on to merge the contents of 3 columns; the QFX memo field can contain up to 256 characters.

- The rightmost column labeled Use determines whether a transaction will be output to the .qfx file or skipped. You can select or unselect all the transactions by selecting the selecting the Use box in the footer.

- Each column name can only be used once - if you need to make many changes, use the Clear button at the bottom to clear out all the column names and start over.

- In our example the only change we will make is to identify the column with the description as Payee & Memo. Since some descriptions are longer than 32 characters this will ensure that we get the full description into Quicken.

- Verify that the signs of amounts are correct. Checking accounts normally have charges as negative numbers and credit card statements have charges as positive numbers. Quicken wants all charges as negative numbers. Use the checkbox for Switch signs of amounts if necessary.

- If you have PDF+ installed you can also edit individual transactions. Select and edit each field as you would in a spreadsheet. Transactions shown in yellow by PDF+ should be corrected, or possibly ignored. You can also create new translations using the Add Transaction button.

- When everything looks correct select the Create qfx button to create a .qfx file containing all the transactions for input into Quicken®. The log will be updated to show the number of transactions written to the .qfx file. The .qfx file will be created in the same folder as the PDF file you converted.

Note that if you view that folder in Windows the file will have a .qfx extension but the file type will be listed as 'Quicken OFX Data'

Note that if you view that folder in Windows the file will have a .qfx extension but the file type will be listed as 'Quicken OFX Data'

Step III - Import the QFX file into Quicken

- Open the .qfx file in Quicken.

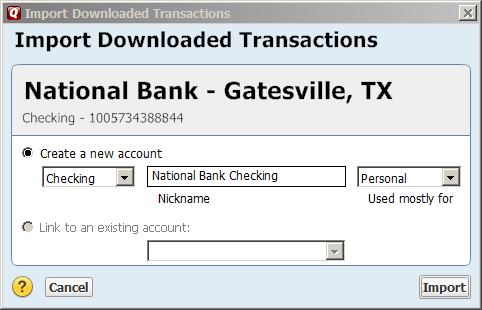

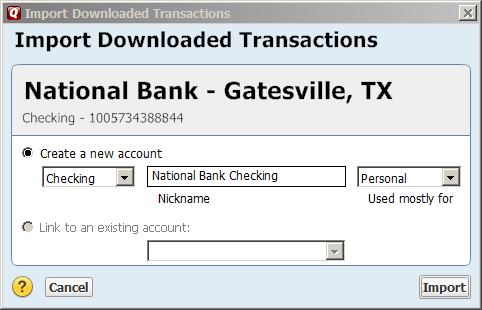

With a default Quicken installation you can simply click the big Import button and the .qfx file will be opened in Quicken. You can also double-click the .qfx file in a folder listing, or from within Quicken, select the File menu, File Import, and Web Connect File... Do not try to import it as a Quicken Transfer File (.QXF) file, that is something entirely different. - The first time you import a .qfx file from a new bank, Quicken will offer to create new account. Quicken will identify the bank name from the FID you selected in the converter. However, you can still name the account with whatever bank name you want. Enter a name for the account and create the account, and import the transactions. In this example we used the FID from National Bank, which is a bank in Texas.

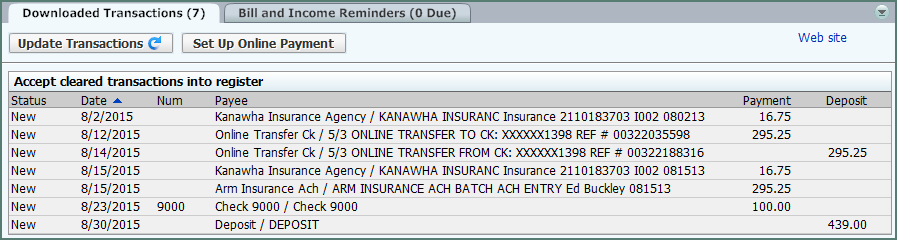

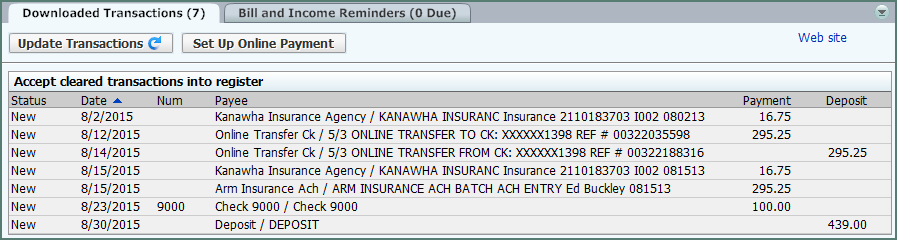

- After importing, depending on your setup, Quicken will display the new transactions at the bottom of the account register, ready to be accepted. Note that because we included the Memo information, Quicken has used the Memo information to create a longer Payee name. You can either accept all the transactions at once or accept the transactions one by one and modify the Payee names and category names to be exactly what you want. Quicken will also simplify the Payee names and change capitalization. You can edit any of that information as you accept transactions, or in the account register.

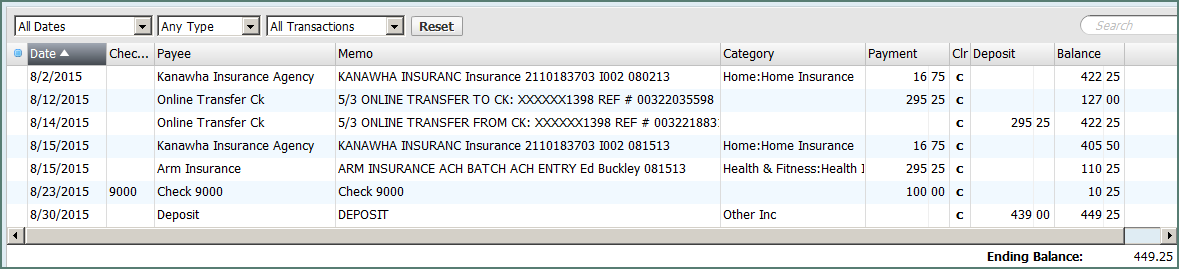

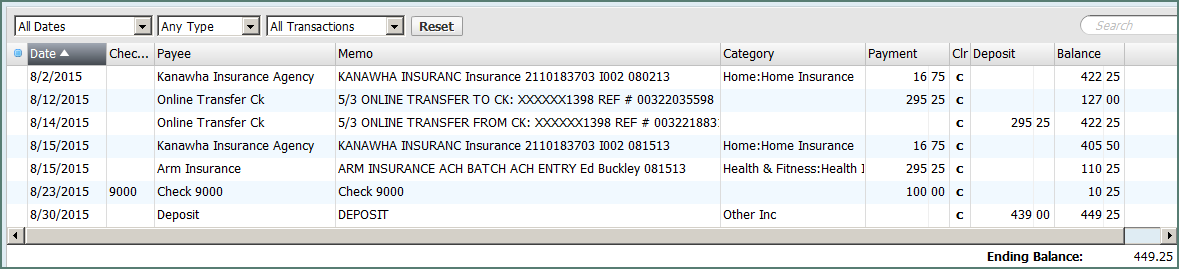

- After all the transactions have been accepted you can view them in the account register. You can also verify that account balance matches the account balance from the original PDF bank statement.

Note that if you view that folder in Windows the file will have a .qfx extension but the file type will be listed as 'Quicken OFX Data'

Note that if you view that folder in Windows the file will have a .qfx extension but the file type will be listed as 'Quicken OFX Data'