pdf2qfx Convert | Help

© Copyright 2019 MoneyThumb LLC

- PDF2QFX Convert

- Getting Started

- Installation

- Entering License Information

- Preparation

- Running PDF2QFX Convert

- Settings Dialog

- Setting Quicken Account Info

- PDF Settings

- Language

- Date Formats

- Positive and Negative Charges

- Assigned Column Names

- Converting the PDF File

- Settings Dialog

- Working with Scanned Documents and PDF+

- Importing QFX files into Quicken

- Troubleshooting

- Your bank is not present in the list of FID's.

- Error Message: "No text found in the PDF file"

- Error Message: "No transactions found in the PDF file"

- Warning Message: "No separate credit/debit sections found. Verify plus/minus sign of amounts"

- Warning Message: "Credit/debit columns not identified. Verify plus/minus sign of amounts"

- Transactions have an incorrect year

- Quicken Error: "Quicken is currently unable to verify the financial institution for this download. Please try again later."

- No transactions visible in Quicken when you import the QFX file

- PDF2QFX Convert Error: Incomplete header...

- No transactions when import the QFX file into Quicken

- Switched Information in Quicken

- Payee name is being truncated

- Investment Accounts

- Multiple Accounts in a singe file

- Saving the PDF2QFX Convert Log

PDF2QFX Convert

This Help file covers PDF2QFX Convert, PDF2QFX Convert+, PDF2QFX Convert+ Express, and the PDF+ AddOn for working with scanned documents.

Getting Started

PDF2QFX Convert is a single step financial data translator that extracts financial transactions from downloaded PDF statements and converts them into QFX format suitable for Quicken® software. PDF2QFX Convert+ adds PDF+, MoneyThumb's integrated text recognition module to handle scanned PDF statements. See the section on Working with Scanned Documents and PDF+ for information regarding PDF+.

Use PDF2QFX Convert to import transaction data into Quicken when the you downloaded statements from your financial institution in PDF format.

To get started first set your Quicken account information and date formats with the Settings button. It is important to select an FID. If your bank or brokerage is not listed, then it is not supported by Quicken, and you need to select the FID of some other bank as a workaround. See more about FID's below.

Then either drag and drop your PDF file into the converter drop zone or select the Convert button to choose a file to convert. This will bring up a standard file chooser to select your PDF Statement. There are two action buttons, plus the cancel button, at the bottom of the file chooser. Use the Preview button to preview how .pdf files will convert, and to assign and verify which column is which before doing the import. Then select Create qfx to create the output file. Once you have converted a file with Preview mode, use the Convert to qfx button to do one-step conversion of other files directly to .qfx file format, suitable for input into Quicken.

Whenever opening a file from a different bank or that has a different style, always first use Preview to verify the column setup. Use the pull-down list at the bottom of each column to select the correct type of information in that column. Be sure to select one Date column, one Payee column, and either one Amount column or both Credits and Debits columns. If you have a balance column, the column selection should be blank (to ignore it). You can also choose which transactions to convert. See more about Preview Mode below.

If the PDF2QFX Convert log has an entry that the conversion did not find separate credit/debit sections, then check the plus/minus sign of the entries in the Preview window. If they need to be flipped, then select the checkbox for Switch signs of amounts on output and the amounts will be correctly output to your .qfx file.

Select Create qfx at the bottom of the Preview Screen to finish the conversion and create your .qfx file. Run subsequent conversions of PDF statements from the same bank with the Convert button, select a file and then Convert to qfx.

Import the .qfx file directly into Quicken simply by selecting the Import button. Or read the .qfx file from within Quicken using File, File Import, Web Connect File. Do NOT try to read as a Quicken Transfer File (.qxf) which is something else entirely.

Installation

- Microsoft Windows® full install

- Download PDF2QFX.exe for Windows, save the file to your computer, and run the installation program by double clicking the file.

- If you do not have have Java installed it will be automatically downloaded during the installation.

- Mac OS X® full install

- Download PDF2QFX.dmg for Mac OS X, save the file to your computer. Locate the file in the download area, open it by double clicking, then and run the installer.app by double clicking it.

- If you do not have have Java installed it will be automatically downloaded during the installation.

Entering License Information

Enter the license by copying the license string (CTRL-C) from the confirmation e-mail and pasting it (CTRL-V) into the converter license dialog. To enter the license string manually from within the program select the License button, and paste (or type) the full license code into the dialog.

On Microsoft Windows, you can copy the license file pdf2qfx.lic from the product confirmation e-mail to the same folder where you installed PDF2QFX Convert - i.e. C:\Program Files (x86)\MoneyThumb\pdf2qfx Convert.

After you enter your license, your license email will be shown in the program title bar, and in About.

Preparation

There are two things to do before running PDF2QFX Convert:

- Download a PDF statement from your bank or brokerage web site. These are often identified with the red PDF or Get Adobe Acrobat logos.

- Get the account number of the Quicken account into which you want to import transactions. If you are creating a new account, then any number will suffice. If you wish to import transactions into an existing account, then Quicken will match up the account numbers, and you will want to import into the correct account.

Running PDF2QFX Convert

On Windows or Mac OS X, double click the PDF2QFX Convert icon on your desktop.

You may also run PDF2QFX Convert from the Windows Start Menu, or run PDF2QFX.exe on Windows or PDF2QFX Convert.app on Mac OS X.

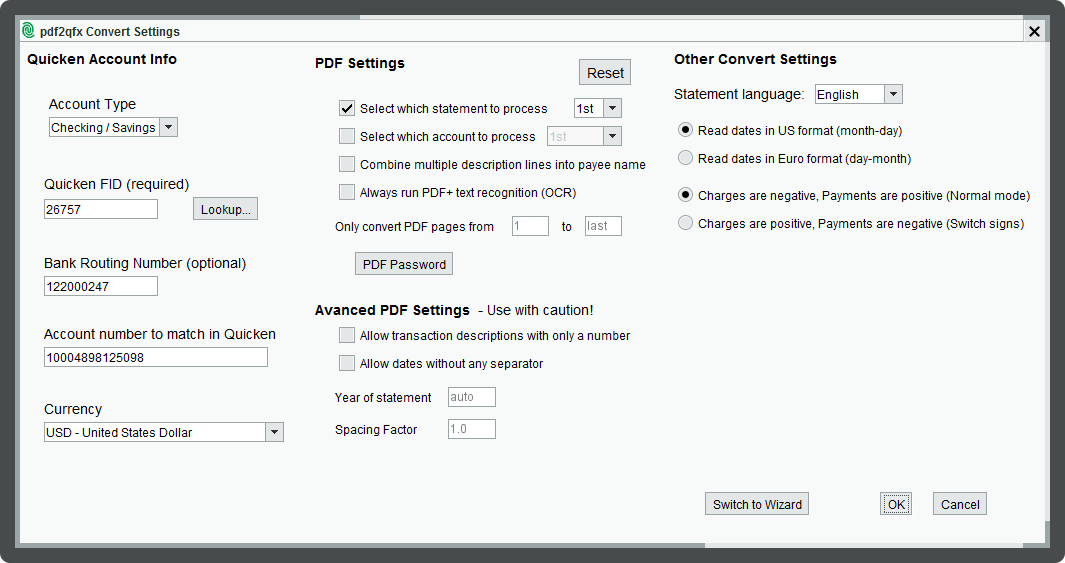

Settings Dialog

Use the Settings button to bring up the Settings Wizard or the full Settings dialog. The Wizard will ask questions that cover the vast majority of conversions. The Settings Dialog contains additional advanced options. You can switch back and forth between the Wizard and the full dialog.

Setting Quicken Account Info

First use the Account Type pull-down menu to select the correct type for the .qfx file - Bank, Credit Card, or Investment. In addition there are four pieces of account information that may be inserted into the QFX file when it is created. The only one of these that is critical is the Quicken FID. This is a four or five digit number that Quicken uses to identify the financial institution. Quicken will validate the FID over the Internet when reading in the QFX file, and it must be correct and valid, or Quicken will abort the file import.

Set the Quicken account information with the Settings button. This will bring up the dialog below. First, select the Account Type as Bank, Credit Card, or Investment in the drop down list.

Select "Lookup..." in the dialog and it will bring up a window with all the Quicken Financial Institutions that are listed for that type of account. Type some or all of the name of your financial institution into the search box at the top to search within the list. Scroll down the list to find your bank and select it. The bank URL is also included to help resolve ambiguity if your bank has a name that is similar to other banks.

If your bank or brokerage is not listed, then Quicken will not import QFX files (Web Connect files) that are identified as being from that financial institution. The only workaround is to use an FID from some other bank. You can still name the account to include the name of your financial institution. So long as you as not also doing Quicken Direct Connect downloads into the same account, it will work just fine. There are some Financial Institutions that provide Direct Connect, but do not support Web Connect, and if you use one of these, you will have to create two accounts and move transactions from one to the other.

Just remember that the FID is critical for Quicken, and although PDF2QFX Convert will run without one, it will give a warning, and Quicken will give an error when reading the QFX file.

QFX files are required to have account information. All files require an account number and bank accounts also require a bank routing number. If you don't want to save your accounts numbers for security reasons, then you can skip entering this this information. If you do provide your account number to be inserted into the QFX file, then Quicken uses that number to automatically determine which account to import into. If you are always importing into the same account, then PDF2QFX Convert will save the information from session to session, so you do not have to re-enter it. For PayPal users, your account number is the email address you use to sign into PayPal. Note that PDF2QFX Convert does not access the Internet at all, so any information entered is only saved on your computer, and is not sent over other web or to any other computers.

To determine the account number to use in the QFX file, PDF2QFX Convert will look in the following locations, in order.

-

-

- Values from the Settings dialog window (see above). Once again, if you are concerned about entering your account number, then don't, and either manually edit the QFX file after it is created, or match up accounts when doing the Quicken import.

- The PDF file name, if it is a number without any letters.

- As a last resort, PDF2QFX Convert will use an arbitrary default number for the routing number and account number. You will then have to manually match accounts when reading the QFX file into Quicken.

-

The bank account routing number is required by QFX for bank accounts (but not for credit cards or investment accounts). However, it is not actually used by Quicken, so if you don't specify one, PDF2QFX Convert will insert a default value and Quicken will accept it.

Lastly, the currency needs to be specified. US Dollars are the initial setting, use the drop down to select a different currency.

PDF Settings

PDF Password

If your PDF statements have a password that you need to enter in order to view them, then use the setting for Set PDF Password. The password is not saved for security reasons, so you need to enter a password each time you start PDF2QFX Convert. However, if you are converting multiple statements that require the same password, the password will be applied to multiple conversions in the same session.

PDF Page Range

If your PDF statement has multiple accounts (such as a checking and a saving account) you can restrict the pages converted so that only a single account is processed. Enter values into the dialog for Only Convert Pages from ... to to specify a page range. The first value is the page number of the first page to convert, the second value is the page number of the last page to convert. All other pages will be ignored.

Year

Many banks simply use the month and date for individual transactions, with the year being elsewhere on the statement. PDF2QFX Convert

determines the calendar year from other dates in the statement. If for some reason the year is not found correctly, this setting allows you to override the year which is used. For statements that appear to cross a year-end boundary, this value is the earlier year.

The Spacing Factor is for PDF Statements that have extremely wide or narrow text. PDF2QFX Convert will automatically determine a good value, but if your initial conversion has extra spaces where they shouldn't be, or no spaces where they should be, this is a way to override the calculated value.

Combine multiple description lines into the payee name tells the converter to combine multi line transaction descriptions into a single (long) payee name, rather than taking the payee name from the first line, and the subsequent lines as the memo. This is useful if the first line has so much extraneous information (i.e. "check card payment made on Jan 1") that the useful payee name is continued to the second line. The resulting long payee names can be shortened with Payee Cleanup.

Allow transaction descriptions with only a number is used if there are transactions that have a 'description' that consists of only a number, such as an account transfer number.

Allow dates without any separator can be used for banks that use a month-day format of 'mmdd', without any space, dash, or slash between the month and day. Setting this option may cause non-date values such as check numbers to be interpreted as dates, so use with caution.

Select which account to process

This option is for bank statements that contain multiple accounts such as a checking account and a savings account. Select this option, and then which account in the statement to process, the first account, second account, etc.

Select which statement to process

This options is for PDF files that contain multiple statements, such as individual monthly statements.

Select the checkbox for this option, and then which statement in the PDF file to process, the first statement, second statement, etc.

Always run PDF+ text recognition (OCR)

(Only visible when PDF+ is loaded). Use this option when your statement may already have text from a previous OCR process. See the section on PDF+ for additional information.

Language

Select the language of the PDF statement. This changes how PDF2QFX Convert recognizes month names and keywords that help determine whether an amount is a credit, debit, or something else.

Date Formats

PDF2QFX Convert can read dates either in US format (month-day-year) or European format (day-month-year). Use the Settings button to select the date format that is used in your PDF file. Note that there is no need to specify a date format for .qfx files.

Positive and Negative Charges

Normally bank statements will have charges as negative numbers and payments as positive numbers. That is what Quicken expects. Many credit card companies switch things so that charges are positive - showing an increase in your balance - and payments are negative. Use the Settings dialog to select Charges are positive, Payments are negative (Switch signs) if this is how your PDF statement is formatted.

Assigned Column Names

Column names can be preassigned to your conversions. Whenever you use Preview Mode, the column names are saved and automatically assigned to subsequent conversions. See the description of Preview Mode, in the following section. The current column names are displayed in the text box in this section.

Converting the PDF File

There are two ways to identify the PDF file to convert:

- Select the file in your operating system file browser (Windows Explorer, Mac Finder), and then drag it into the converter "Drop Zone"

or

- Select the Convert button in PDF2QFX Convert to bring up the file chooser and select the file to convert.

PDF2QFX Convert can be run in two modes - Preview Mode and Express Mode. If you are just getting started, then use Preview Mode. If you have run PDF2QFX Convert previously on a similar file and are sure that the columns are correct, then it's faster to use Express Mode.

Preview Mode

Select the Convert button and this will bring up the file chooser dialog. Navigate to the folder containing the .pdf file, select the file, and then select Preview at the bottom of the dialog.

This will extract the transactions from your PDF file and bring up a preview window that displays the transactions which were found. The account type at the top of the window will be fixed to the Quicken account type you chose in the Settings dialog. At the bottom of each column is a selector that contains the name of the data in that column. It may have already been set correctly by PDF2QFX Convert based on column headings in the PDF file. If it's not correct, use the pull-down to select the correct type of data. Each type can only be used in one column, so types that have already been used will be grayed out. If you have many columns, you can increase the width of the columns of interest by going to the header row and dragging the column separator to increase the width of the column, and of course drag a corner of the window to enlarge it as well.

Most credit card statements have the the signs of amounts reversed so that credits are a minus amount, and charges are positive. If separate credits and debits sections were not found, then the preview screen may show credits as negative. In this case the checkbox for Switch signs of amounts should be selected. This will ensure that debits and credits are correctly labeled in the QFX file, and imported correctly into Quicken.

Use the ![]() icon to bring up an image of the original PDF page with the transaction highlighted. This is especially helpful when touching up OCR typos.

icon to bring up an image of the original PDF page with the transaction highlighted. This is especially helpful when touching up OCR typos.

The only required columns are the Date, Payee, and depending on whether the transaction amounts are in one column or two, either Amount or both Credits and Debits. If your statement has an Amount column that has positive amounts for both credits and debits then you also need to select a Type column that has the type - typically Credit/Debit or CR/DB. If your PDF statement has a column for 'Balance", it should not be used - the entry in the pull down list should be blank. Quicken will calculate the balance using all the transactions in the account. Use the Clear button to empty the column selectors and start over.

The Payee column is the downloaded payee name for your accounting application. You can also have the payee name duplicated at the start of the memo field by using the Payee & Memo selection. This is useful if you need to see more than the QFX limitation of 32 characters for the payee name.

The Number column is used for Check Numbers, if those are present in your PDF Statement. The Transaction ID column should only be used for credit card statements that have a unique reference number for each transaction.

To create a Memo that combines two different columns choose Memo for the the first part of the memo, and Memo Add-on for the second part. The text from the two columns will be combined into a single Memo, with a space between the two text strings.

For brokerage accounts, the Action column is the type of transaction such as Buy or Sell, the Security Name, ticker Symbol, and CUSIP are the various security identification fields and the Quantity, Price, Commission, and Total fields describe the transaction.

The column called Use determines whether the transaction will be processed into the QFX file. If you have some transactions that you wish to ignore, deselect the checkbox in the Use column. Use the checkbox at the bottom to deselect or select all transactions.

When the column names are correct select Convert at the bottom of the preview window. The conversion will proceed, giving some statistics on how many lines were processed and create a QFX file with the same name. If a QFX file with that name already exists you will be prompted to overwrite it.

Preview Mode column settings will be automatically remembered, and will apply to subsequent Express Mode conversions. To clear Preview Mode, run a different file in Preview Mode.

Payee Cleanup

When downloading bank transactions, very often payee names will have extra information such as dates, phone numbers, store numbers, transaction type descriptions, and so forth. While in Preview mode, use Payee Cleanup Settings to automatically remove that extraneous information. The Cleanup dialog is side by side with the Preview dialog so that you can specify changes and instantly see the cleaned-up payee names. The cleanup filters will only affect the column selected as Payee or Payee & Memo at the bottom of the dialog.

Most of the filter options remove a specific type of text and should be self explanatory. You can also specify up to 100 phrases to be removed. Phrases can include wild cards. Use a question mark (?) to match a single character or an asterisk (*) to match multiple characters at the beginning or end of a word. Some frequently used phrases are in the hints for the first few entries. The best way to specify phrases is to start typing and see how each character that you type affects the payee names in the Preview transactions. If you have many payees you might want to expand the size of the Preview dialog and you can also scroll through the list of transactions while the Cleanup dialog is visible.

To remove phrases such as 'PayPal *' or 'SQ *' that prefix the actual payee you can either specify a string such as "Paypal ?" or "SQ ?", or you can remove all special characters and specify a single word removal string such as Paypal or SQ. All phrase removal is case insensitive - for example PayPal, paypal, or Paypal will all remove the word paypal, regardless of how it is capitalized.

If you are familiar with regular expressions, you can also use regular expressions as a removal option. Start and end the removal string with a slash (/) to have it recognized as a regular expression.

Note that filters are applied in the same top to bottom order displayed in the dialog, so that for example a store number such as '#2032' would be removed before special characters, which includes the #.

Express Mode

Express mode can be used for all conversions, although it is highly recommended that whenever converting a .pdf file from a new source, you should first use Preview mode. Run Express mode by either dragging and dropping a file from the file explorer with the Ctrl key pressed (Command key on a Mac) or select the Convert button to bring up the file chooser dialog, select a file, and then Convert to qfx.

PDF2QFX Convert will run, giving some statistics on how many lines were processed and create a .qfx file with the same name. If a .qfx file with that name already exists you will be prompted to overwrite it. When creating a QFX file, if the converter detects the the current Preview settings will not work with the file being converted, it will automatically enter Preview mode so that the column can be configured correctly.

Working with Scanned Documents and PDF+

This section is only applicable if you purchased PDF2QFX Convert or the PDF+ AddOn. Running with PDF+ is virtually identical to running the normal version. In most cases the converter will recognize that the PDF statement does not contain readable text, and will automatically invoke the text recognition module. The main noticeable difference is that the text recognition takes much longer than files that don't need text recognition.

When scanning documents to be processed by PDF2QFX Convert+ it is best to scan at a resolution of 300 dpi (dots per inch). Most scanners should have this as an optional setting. And obviously the cleaner and crisper the document scans, the better the recognition will be. A speck of dirt in the wrong place, such as making a keyword like 'Debits' unintelligible can throw off the entire conversion.

After text recognition and conversion, the converter will also automatically refine any transaction date or amount values that appear to be incorrect with Pin Point recognition, and redo the conversion. The number of values refined will be shown in the converter log. If there are still values that appear to be incorrect, the converter log will list the number of lines that should be manually corrected, and identify those lines in Preview mode. Those transactions will be highlighted in yellow, and will have the Use box unchecked.

You can then review the text in those lines, and edit them to make any necessary corrections. Edit like you would a spreadsheet - select the cell and then edit the text in that cell. Sometimes the highlighted lines may be extraneous text that is not a transaction, simply ignore those. If you do edit the lines to create valid values, check the Use box so that they will in included in the output. You can also edit any other text, and if something is missing, even insert a new transaction using the Add Transaction button. If you don't want to include a line, uncheck the Use box.

In the example above, there were a few transactions where the 'g' in 'Aug' was fuzzy and was recognized as 'a'. In this instance one should change those dates to 8/25/2012 and 8/27/2012, and then the statement will be completely correct.

f you are converting scanned documents that had text recognition done by other Optical Character Recognition (OCR) software then you can choose to either use the text from the previous OCR software or use the MoneyThumb's integrated PDF+ with Pin Point text recognition. The Settings option Always run PDF+ text recognition (OCR) tells the converter to always use PDF+ text recognition. If that box is unchecked PDF2QFX Convert+ will process those files using the searchable text created by your previous OCR. Always running with text recognition will take substantially longer, but will also generally get more accurate results than using the results from other OCR software. That is especially true when compared to free OCR software that may have come with your scanner.

Lastly, there are also a few banks that create PDF statements from images and a very few who create PDF statements with an internal encryption. Bank statements created from images should automatically be processed by PDF+, since no readable text will be found. Statements with an internal encryption will generate unusable text, so , they can only be correctly processed by using the Settings option above. You can recognize these statements by copying and pasting text from your PDF reader to any editing program, and seeing random text characters rather than the text you copied.

Importing QFX files into Quicken

The easiest way to import the QFX file is simply to select the Import button, which will cause open the file in Quicken. Alternatively you can double-click the QFX file when viewed in Windows Explorer or Max OS X Finder. Another method is to read the QFX file while running Quicken. Select File, then from the pull-down menu select File Import, and then Web Connect File... This will bring up the standard File Open dialog, select the file, and then select Open. The transactions should be read into Quicken. Do NOT try to read the QFX file as a Quicken Transfer File (.QXF) which is something else entirely.

One of the advantages of using QFX file format is that Quicken 'remembers' which transactions it previously read, and will not read the same transaction again. If your PDF file has a transaction ID from your financial institution, then make sure that the column header is correct, and PDF2QFX Convert will use that transaction ID. PDF2QFX Convert will generate transaction Id's if they are not available, but they will not match up with direct downloads from your financial institution.

Troubleshooting

Your bank is not present in the list of FID's.

The list of FID's (Financial Institution ID's) actually comes from your Quicken install, and is the list of banks that have paid to be included as a Quicken supported bank. A bank may be supported for checking accounts , credit cards, investment accounts, or any combination thereof. Similarly a bank may be supported for Direct or WebConnect downloads, or both. And the list is country specific. If your bank chose not to be included, then it will not be in the FID list and Quicken will not import transactions using that bank name. It has nothing to do with PDF2QFX Convert. However, there is a very simple workaround which is to use the FID of some other Financial Institution. You can use pretty much any other FID you want. You should probably choose one that is not a bank you have other accounts at, is a large bank that is unlikely to drop Quicken support, and has a name that is similar to or that you can associate with your bank name.

Error Message: "No text found in the PDF file"

This error generally means that the PDF file is a image file, not a text based (or searchable) PDF file. Image PDF's are created when scanning or a small minority of banks create a PDF statement with a few images rather than text. You can verify this by trying to select a line of text while viewing the PDF file in Adobe Acrobat. Depending on the type of PDF file, the selection are will either snap to a line of text, or just be a rectangle following the cursor.

It is also possible that the PDF is encrypted; try to copy/past text from Acrobat to any editor and if the text does not paste correctly, then the PDF is encrypted. In either case you will need PDF2QFX Convert+ with text recognition in order to process this file. You could also use other OCR software, although MoneyThumb's PDF+ is unique in being optimized for recognizing financial transactions.

Error Message: "No transactions found in the PDF file"

This error can be caused by anything from PDF2QFX Convert not working correctly on your bank's PDF file to a PDF file that has internal encryption or images that makes it impossible to convert.

A quick test is to verify whether the text in the statement is extractable. Open the statement with Adobe Acrobat, select the text for a transaction, and use Edit, Copy to copy the text to the clipboard. Open any kind of text or document editor (i.e. Notepad, Word, TextEdit, Pages) and paste the text into the program.

If the text does not paste correctly, then it's an image, or somehow encrypted, and the statement can only be processed with PDF2QFX Convert+. You may need to turn on the Settings option for Always run text recognition (OCR).

If text was processed, there should be a line in the log like "Found 100 lines with a date, 90 lines with a currency value, 80 lines with both." If this line is missing or the number of lines found is much lower than expected, then the statement has spacing, date, or currency formats that are not being recognized. One thing you can try, especially for scanned documents, is to adjust the Spacing Factor in the Settings menu to a number such as 1.5 or 2.0.

If date and currency values were found, then the formatting of the statement is likely causing a problem. If your statement has multiple sections for different accounts, that can sometimes cause confusion. It can often be corrected by only processing pages for one section of the file at a time. Enter values for Only convert PDF pages from .. to .. in the lower right of the Settings menu.

If transactions are still not being found, you would need to send a test file to MoneyThumb for further investigation. We can send you a procedure to remove personal information from the PDF statement.

Warning Message: "No separate credit/debit sections found. Verify plus/minus sign of amounts"

If the PDF2QFX Convert log ends with this message, then PDF2QFX Convert was unable to find distinct sections for credits and debits in the PDF statement. If your PDF statement has plus and minus signs, then you should check that they are correct and if not, use the Switch sign of amounts setting in the top right of the Preview dialog to switch all credits and debits. If you are running multiple statements from the same bank, use Settings to set the switch signs option for all conversions. If all your transactions are positive numbers, then PDF2QFX Convert was unable to recognize the sections correctly. If all your transactions are positive, then PDF2QFX Convert was unable to recognize the sections correctly.

A workaround is to run PDF2QFX Convert twice; select all the credits the first time, and then the debits, switching the Switch sign of amounts checkbox so that the transactions are positive on the first run and negative on the second. Select the checkbox under the Use column to choose which transactions will be processed. The checkbox at the bottom of that column will select/deselect all transactions.

Warning Message: "Credit/debit columns not identified. Verify plus/minus sign of amounts"

This warning is similar to the warning above regarding credit/debit sections, but PDF2QFX Convert did find separate columns for credits and debits, just could not determine which is which. Therefore, you should simply ensure that the debits and credits columns are identified correctly in Preview mode. If the columns in your statement do not distinguish credits and debits, then you should use the Settings option for Process statement as a single currency column.

Transactions have an incorrect year

Most bank statements don't have the year on individual transactions but have the year in the statement date. This is normally picked up by PDF2QFX Convert. However if the statement date is not present or there are other dates found in the statement, sometimes all the transactions will have an incorrect year. To override the year value found in the statement, specify a year in the Settings menu, using the Year value on the lower right. If you specified a year and are getting incorrect results, note that for a statement that appears to cross the year boundary in any way (even an old balance) specify the year in the month of December. Generally the converter works best if you leave the year override blank.

Quicken Error: "Quicken is currently unable to verify the financial institution for this download. Please try again later."

When you import the QFX file into Quicken, if you receive an error "Quicken is currently unable to verify the financial institution for this download. Please try again later." then the FID is incorrect. Quicken is very picky about this. The financial institution must be currently in good standing with Quicken for Web Connect download, and the account must be of the correct type. Quicken distinguishes between financial institutions that support investment accounts versus those that support bank and credit card transactions.

PDF2QFX Convert will only display those FID's that are listed as being able to import Web Connect files of the account type you selected. If you don't see your bank or brokerage, Quicken will not accept Web Connect files from that financial institution. Quicken tends to have different names for banks and brokerages at the same financial institution and if your financial institution does not support web connect for the type of account you are trying to import, then even though you choose a bank with the same name as your brokerage, you will get the error listed above when trying to import into Quicken. Also, even though a bank may be listed, Quicken may still give this error. That problem seems mostly to occur with small banks, perhaps they did not stay current with Quicken.

If you are running into a brick wall with Quicken FID's, one workaround is to use an FID for some other financial institution other than the one you actually use. However, if you already are downloading from your financial institution, then you would have to have two accounts and copy transactions from one to the other. Therefore, this is practical only if you don't already download directly from that financial institutional, or you import transactions very infrequently.

If Quicken is refusing to link a QFX import to an existing account, then make sure that the account type was set correctly - see the section above on Setting Quicken Account Info. Quicken will only allow you to import credit card QFX files to credit cards accounts, bank account QFX files to bank accounts, and so forth. If the account number was not specified accurately in the Quicken Account Info, then Quicken will generally allow you to do a manual match, but it will also change the account number in Quicken.

No transactions visible in Quicken when you import the QFX file

The most common reason for this is that you need to accept the transactions into the Quicken account register. In Quicken, go to the account register, select the Downloaded Transactions tab at the bottom of the register, and accept the transactions.

Also review the log in the PDF2QFX Convert log window, and make sure that the transactions were processed. If not, the cause may be a missing header - see next paragraph.

PDF2QFX Convert Error: Incomplete header...

There are missing columns which are needed to process the PDF file. The date might be missing, there might be a credits column without a debits column, or similar types of missing data. Review the column names in Preview Mode.

No transactions when import the QFX file into Quicken

Review the log in the PDF2QFX Convert log window. Often the cause is a missing header. Use Preview Mode to correct the column description using the pull-down menus at the bottom of each column. To enter Preview Mode, run the conversion by selecting the Preview button rather than the Convert to qfx button.

Switched Information in Quicken

If you are importing the QFX file into Quicken and information is switched (i.e. the Payee is what you expected for some other field) then the headers in the PDF file may be mislabeled. Use Preview Mode to correct the column description using the pull-down menus at the bottom of each column. To enter Preview Mode, run the conversion by selecting the Preview button rather than the Convert to qfx button.

If your bank statement has one column for credits and another column for debits, then make sure that those columns are correctly labeled.

If your banks statement has all the amounts in a single column and the amounts are switched (i.e. credit card charges are showing up as positive rather than negative) then use checkbox Switch signs of amounts (in the upper right corner of the Preview Mode screen.

Payee name is being truncated

The QFX file format does not permit payee names longer than 32 characters. That can cause problems with longer payee names being truncated on import into QuickBooks. It is not possible to change that limitation, but PDF2QFX Convert does have a workaround. In Preview Mode, select the column definition for the payee to be Payee & Memo. This will put the payee into both the Payee field (truncated to 32 characters), and the start of the Memo field. This will make the full payee name visible in your Quicken transactions.

Investment Accounts

Although Quicken does allow the importing of QFX files with investment transactions, many well known brokerages (Fidelity and Charles Schwab to mention two) only support Direct Connect downloads and do not currently support Web Connect, i.e. QFX files. In fact most brokerages that support Direct Connect do not support QFX. The Quicken FID list specifies what types of files each financial institution handles - Direct Connect, or Web Connect (QFX) - and if your brokerage is not listed as being able to import QFX files, then Quicken will not allow you to import transactions from that brokerage. If your brokerage web site does not provide the ability to download a QFX file, then you will probably not be able to import one, even though the file is completely valid. See the paragraph above regarding Errors.

Converting Security Names in Investment Transactions

When importing QFX files, Quicken relies on the security name and the security CUSIP. The CUSIP is a 9 digit field that uniquely identifies the security. However, most brokerage statements will not contain a column with the CUSIP. If there is no CUSIP present, PDF2QFX Convert will give a warning and use an alternate method of defining the security name. This method is accepted by Quicken, but the securities in the QFX file may not be matched up with previous securities downloaded into Quicken.

Multiple Accounts in a singe file

Because a QFX file can only contain transactions from a single financial institution, PDF2QFX Convert will only process the first account found in a PDF file when creating a QFX file. To process other accounts in the PDF Statement, use the Setting option for Select which account to process and select the appropriate account - first, second, third. etc. Or select Only convert PDF pages from .. to .. to restrict the portion of the statement which is processed.

Saving the PDF2QFX Convert Log

After PDF2QFX Convert has run, you may wish to save the log information to a file. Select the Save Log button. This will bring up a File Save dialog. Simply specify a file name and select Save.

To clear the log information select the Clear Log button.